There are four parties involved in a typical 1031 exchange: the Taxpayer or Exchangor, the Buyer of the Relinquished Property, the Qualified Intermediary and the Seller of the Replacement Property.

There are four parties involved in a typical 1031 exchange: the Taxpayer or Exchangor, the Buyer of the Relinquished Property, the Qualified Intermediary and the Seller of the Replacement Property.

- The Taxpayer or Exchangor: owns an investment property and would like to exchange it for another investment property.

- The Buyer: is the person who wants to purchase the Taxpayer’s property.

- The Seller: is the person who owns the property that the Taxpayer wants to acquire in the exchange.

- The Qualified Intermediary (QI): performs the essential functions to allow a 1031 exchange to qualify under the “safe harbor” as outlined in Treasury Regulation 1.1031(k)-1(g)(4). A QI, is an independent third party to the transaction who prepares the necessary exchange documents, receives the proceeds from the sale of the relinquished property and holds the funds in escrow until the client is able to identify and subsequently purchase a replacement property.

- The Relinquished Property: the property originally owned by the taxpayer and which the taxpayer would like to dispose of in the exchange.

- Replacement Property: the property that the taxpayer would like to acquire in the exchange.

In order for an exchange to be completely tax deferred: 1) the replacement property must have a fair market value equal to or greater than the net sales price of the relinquished property; and 2) all of the taxpayer’s equity or more must be used in acquiring replacement property. This is known as trading up or equal in value and up or equal in equity, and it is essential if the taxpayer desires to defer the tax on all of the gain.

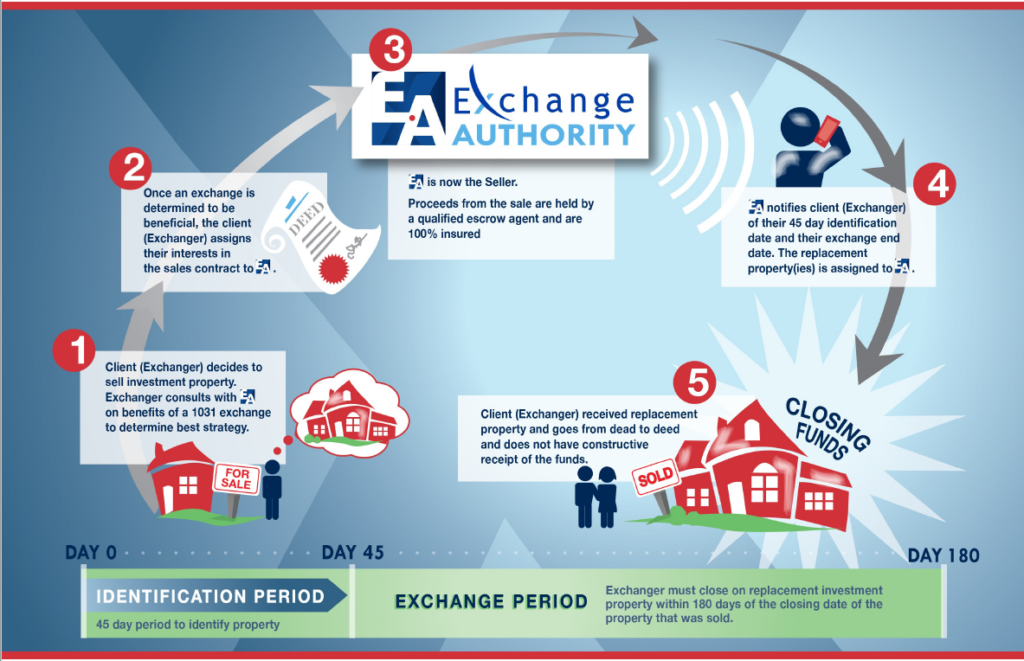

The initial step in most exchanges occurs when the taxpayer and the QI enter into an Exchange Agreement. The QI is then substituted for the Taxpayer as the seller in the agreement for the sale of the relinquished property by way of an assignment of the relinquished property contract. In order to have a valid 1031 exchange, the Taxpayer may not actually or constructively receive the proceeds from the relinquished property sale. At the closing of the sale relinquished property to the buyer the QI receives and holds all net sales proceeds in the exchange escrow. The date of such deeding is called the initial transfer date.

On or before the expiration of 45 days after the initial transfer date, the Taxpayer must identify the replacement property to the QI. The Taxpayer then enters into an agreement to purchase the replacement property from the seller. Again, the QI is substituted for the Taxpayer as the buyer in the agreement. At the closing of the replacement property, the QI transfers the cash to close to the settlement agent and the replacement property is directly deeded to the Taxpayer. This final transfer, which concludes the exchange, must occur before the expiration of the exchange period. Following the termination of the exchange, the QI transfers any remaining escrow funds, if any, to the taxpayer.